FINANCE &

iNVESTMENT

Financing is at the heart of energy transition

The Nigerian Government designed the Energy Transition Plan (ETP) to tackle the dual crises of energy poverty and climate change; and outline a pathway to achieve net-zero status by 2060, while also providing energy for development, industrialization, and economic growth. To deliver net-zero target by 2060, Nigeria requires ~$410 billion above business-as-usual spending (between 2021 – 2060). Nigeria’s Energy Transition Office has identified an initial $23 billion investment opportunity across a portfolio of projects, out of which ~$17 billion is estimated as funding required through the private sector, across generation, transmission and distribution, metering, gas commercialization, clean cooking, e-mobility, and healthcare.

Nigeria needs to unlock an enormous amount of financing from various sources of capital, both domestic and foreign, to fund its just energy transition. The scale and ambition of the ETP underscores the important role of the private sector in bridging financing gaps, and mainstreaming private sector led climate-friendly and innovative financing solutions for Nigeria’s transition to net zero. A successful transition will require commercial investment capital, blended structures in the form of public- private partnerships and concessional capital and development funding from a combination of philanthropists and multilateral development financiers.

A green leap forward

Approx. $ 500 billion USD will be required in capital investments across different sectors for Nigeria to reach Net-Zero by 2060 above BAU

| Investment, selected projects (Net-Zero) |

Cumulative Total Investment, Billion USD | ||

|---|---|---|---|

| SECTOR | PROJECT ARCHETIPES | 2020-2040 | 2040-2060 |

POWER POWER |

Grid and off-grid generation technologies incl. renewables, battery storage | 138.4 | 264.3 |

TRANSMISSION AND DISTRIBUTION TRANSMISSION AND DISTRIBUTION |

Transmission and distribution extension and upgrades | 138.4 | 162.5 |

INDUSTRY INDUSTRY |

Clean high and low-temperature heating processes including in steel and cement industries | 138.4 | 34 |

CLEAN COOKING CLEAN COOKING |

Clean cookstoves and fuels | 138.4 | 8.7 |

TRANSPORT TRANSPORT |

Electric two-wheelers, cars, buses, trucks including heavy road machinery for agriculture | 138.4 | 410.2 |

HYDROGEN HYDROGEN |

Green & Blue hydrogen for storage and industrial processes | 138.4 | 56 |

| TOTAL | 830.4 | 936.7 | |

- Financing a Net-Zero 2060 Pathway

Nigeria will require approx. 500 Bn USD (above BAU) to achieve Net-Zero emissions in the power sector and sustainably power various sectors to meet social and development targets in industry, transport and clean cooking.

- Financial Partnerships

- Households and individuals

- Corporate and Private Sector

- Public institutions

- Green finance funds and pension funds

- Private foundations

Smart Capital: Unlocking Value in Nigeria's Net Zero Investment Plan

Smart Capital: Unlocking Value in Nigeria's Net Zero Investment Plan

Nigeria’s transition to Net Zero presents a distinctive investment opportunity that requires careful financial structuring. While the transition demands significant front-loaded investments, it delivers substantial long-term savings compared to a Business as Usual (BAU) scenario. This financial dynamic creates unique opportunities for innovative financing approaches while requiring careful risk management.

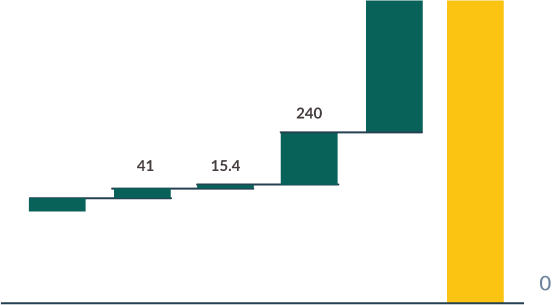

Investment Profile

Financing would need to be structured across two major phases with a majority of efforts required in the power and transport sectors. The initial phase focused on universal energy access, running from 2020 to 2040, requires a mobilization of $432 billion to establish critical and foundational infrastructure and systems. This would then need be scaled up with an additional $935 billion through 2060 for Nigeria to successfully transition to Net-Zero by 2060. This phased approach allows for gradual market development while recognizing the urgency of early action in expanding critical infrastructure and propel Nigeria’s development trajectory.

Cost-Benefit Analysis

Despite the higher capital requirement, the economic case for this transition is compelling and promotes massive fuel savings. The investment generates $686 billion in fuel cost reductions over the period, delivering a net saving of 8% on total expenditure. These operational savings provide a strong foundation for structuring long-term financing mechanisms and demonstrate the commercial viability of the transition.

Financial Structuring and implications

Successfully raising the capital will require different approaches and will be dependent on several risk mitigating factors. Blended finance approaches will be essential to manage risk-return profiles across different project types. Phased capital deployment strategies would also be required to align with technology maturity curves and market development. Sector-specific financing instruments will need to accommodate varying project scales and revenue models. Risk-sharing mechanisms will be crucial for attracting private capital, particularly in early-stage technologies. Finally, the long-term nature of returns requires patient capital with appropriate governance structures.

Emerging

Constraints

Here are some of the themes that have emerged as constraints

to

unlocking private funding for energy transition projects.

1

Limited scale in the ETP investable pipeline as well as the visibility of that pipeline. There is a lack of (bankable) pipeline and project development support, including for bridging the disconnect between actual projects and the available capital.

2

Suboptimal demonstration cases and projects required to deliver proof of concepts and build the viability case to potentially attract the buy-in from institutional funders.

3

Insufficient financial innovation, as the local market has been slow to adopt new instruments that can crowd in funding for energy transition projects. Furthermore, there is relatively little evidence to suggest that practitioners are proactively thinking about designing new and innovative instruments and mechanisms that could accelerate the mobilisation of private sector funding for energy transition projects.

4

Skills shortages related to knowledge transfer and upskilling capacity required for the power, oil and gas and buildings (cooking) sectors. There is a lack of specialist skills and expertise in the local market to drive the capacity required for building a pipeline of low-carbon projects in the ETP’s five sectors.

5

Governance/leadership vacuum to drive sustained private sector ETP engagement and enhance trust between stakeholders. Specifically, the public sector has a suboptimal track record of developing viable funding opportunities and projects that can be taken to the private sector with appropriate instruments. Private sector stewardship is required to support the preparation of priority ETP projects and accelerate the financing of energy transition projects.

6

Poor-quality data and ESG climate reporting standards. Data demands of ESG are a key factor that could deter investment by the private sector into energy transition. Collecting, collating and packaging ESG data is resource intensive and requires technical expertise to ensure that the data is of good quality.

7

Undeveloped market for renewable energy (RE) component assembly and manufacturing for renewable energy installations (solar PV, batteries and other related inputs).